Which Type of Credit Is Used to Lease a Building

A willingness to pay a higher rate of interest will also sweeten the deal for the other company. Rent utilities all building expenses including structural repairs.

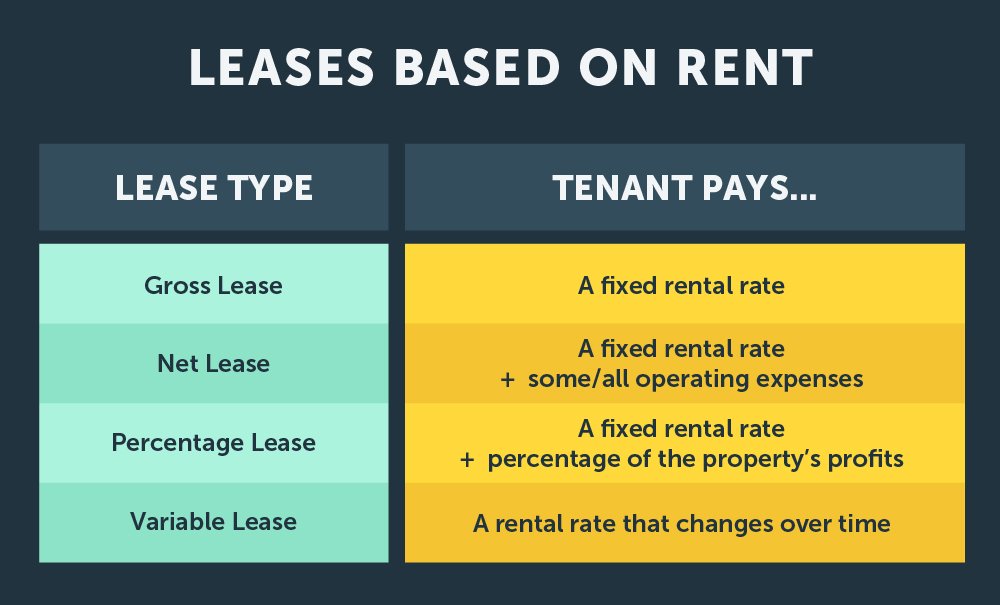

The Four Types Of Commercial Leases

Ownership of the underlying asset is shifted to the lessee by the end of the lease term.

. Nafar wants to start her own business as a contract writer. A lessee should classify a lease as a finance lease when any of the following criteria are met. Leasing property to a business in which the lessor materially participates.

She has to purchase basic low-cost work. Modified gross leases vary widely. This step-by-step guide covers all the basics.

Financial Credit Information Needed to Lease Commercial Real Estate. The lessees incremental borrowing rate is 10. The lessee A signs an agreement with the lessor B to lease a building on Jan.

Offer a large security deposit to show you are serious and have a lot at risk if you do not honor the agreement. Since B will materially participate in the operation the 30000 of income from leasing the building is. Its typically used in lieu of cash for the security deposit required when renting commercial real estate.

Rather than write a check for the security deposit the bank issues a letter to the landlord guaranteeing. The lessee has a purchase option to buy the leased asset and is reasonably certain to use it. Installment credit Secured credit card Service credit Unsecured credit card.

Credit guidelines for renting an apartment vary depending on the community and property manager. A lease is an arrangement under which a lessor agrees to allow a lessee to control the use of identified property plant and equipment for a stated period of time in exchange for one or more payments. The landlord covers all other building expenses.

When leasing commercial real estate office retail warehouse space landlords WILL require some sort of financials and credit information about you personally andor your business. Rent utilities a portion of building operating expenses. A tax credit property is an apartment complex or housing project owned by a landlord who participates in the federal low-income housing tax credit LIHTC program.

The rest of the buildings operating expenses. A letter of credit LOC is a document that guarantees rent payments up to a negotiated amount to a landlord in the event you tenant do not pay your commercial lease payments. 331 Transfer of ownership.

The lease period no renewal options is 10 years. It is a legally binding contract and a good. Anya runs a dog wash and spa service.

A lease is classified as a finance lease by a lessee and as a sales-type lease by a lessor if ownership of the underlying asset transfers to the lessee by the end of the lease term. In a lease the company will pay the other party an agreed upon sum of money not unlike rent in exchange for the ability to use the asset. The present value of lease payments is 1 million.

Triple Net Lease NNN Lease The tenant pays all three nets on a typical lease taxes insurance and CAMs in addition to base rent. This criterion is also met if the lessee is required to pay a nominal fee for the legal transfer of ownership. Make sure to take the following steps while investigating.

For larger creditworthy tenants. Up to 25 cash back Many commercial leases are not based on a standard form or agreement. Equifax Experian and TransUnion offer several credit screening products for the rental market.

Even in situations of no credit or poor credit alternatives. The absolute type is common in single-tenant systems where the property owner builds housing units to suit the needs of a tenant. While looking for a new property.

Offer to pay a portion of a commercial lease with a strategic partner. You cannot easily break or change a commercial lease. Which type of credit is used to lease a building.

There are several types of lease designations which differ if an entity is the lessee or the lessor. Be willing to add collateral in addition to a large cash deposit. Which type of credit is used to lease a building.

The annual lease payment due on Dec. The lease term covers the major part of the underlying assets. If a company makes 1000 in monthly lease payments and its estimated interest is 200 this produces a 1000 credit entry to the cash account a 200 debit entry to the interest expense account.

B owns all the stock of N Inc a C corporation in which he materially participates. To do this she needs to build an office addition to her house. In accounting are operating and financing capital lease leases.

Here are the most common forms of tenancy agreements. As a result you need to carefully examine every commercial lease agreement offered to you. Whether you are an existing business or a startup especially when youre a startup you will be required to show.

Each commercial lease is customized to the landlords needs. In an absolute net lease the tenant takes care of the entire burden including insurance taxes and maintenance. Double Net Lease NN Lease The tenant pays base rent plus their share of the buildings property taxes and insurance.

Installment credit Secured credit card Service credit Unsecu Get the answers you need now. Before you sign a commercial lease agreement youll have to do some research. The two most common types are on-balance sheet capital leases and off-balance sheet operating leases.

These services may require an applicant to initiate the check and generally count it as a soft. B leases a building to N netting 30000 of rental income annually. A lease is a type of transaction undertaken by a company to have the right to use an asset.

Which type of credit is used to lease a building. A lease is a simple financing structure that allows a customer to use energy efficiency renewable energy or other generation equipment without purchasing it outright. Less common office lease type.

We describe these designations next. Which type of credit is she most likely to use.

What Financials Are Needed For A Commercial Lease

How To Lease Commercial Real Estate The Ultimate Guide

Did You Know That You Can Use An Equipment Lease To Start Building Credit For Your Business Let Us Help You G Start Up Business Start Up Small Business Loans

/low-angle-view-of-residential-houses-and-shops-in-tribeca--new-york-city--usa-1137384133-69c42b321e3240a3a7b327cda031e1f6.jpg)

No comments for "Which Type of Credit Is Used to Lease a Building"

Post a Comment